Start your business

Choose your business structure

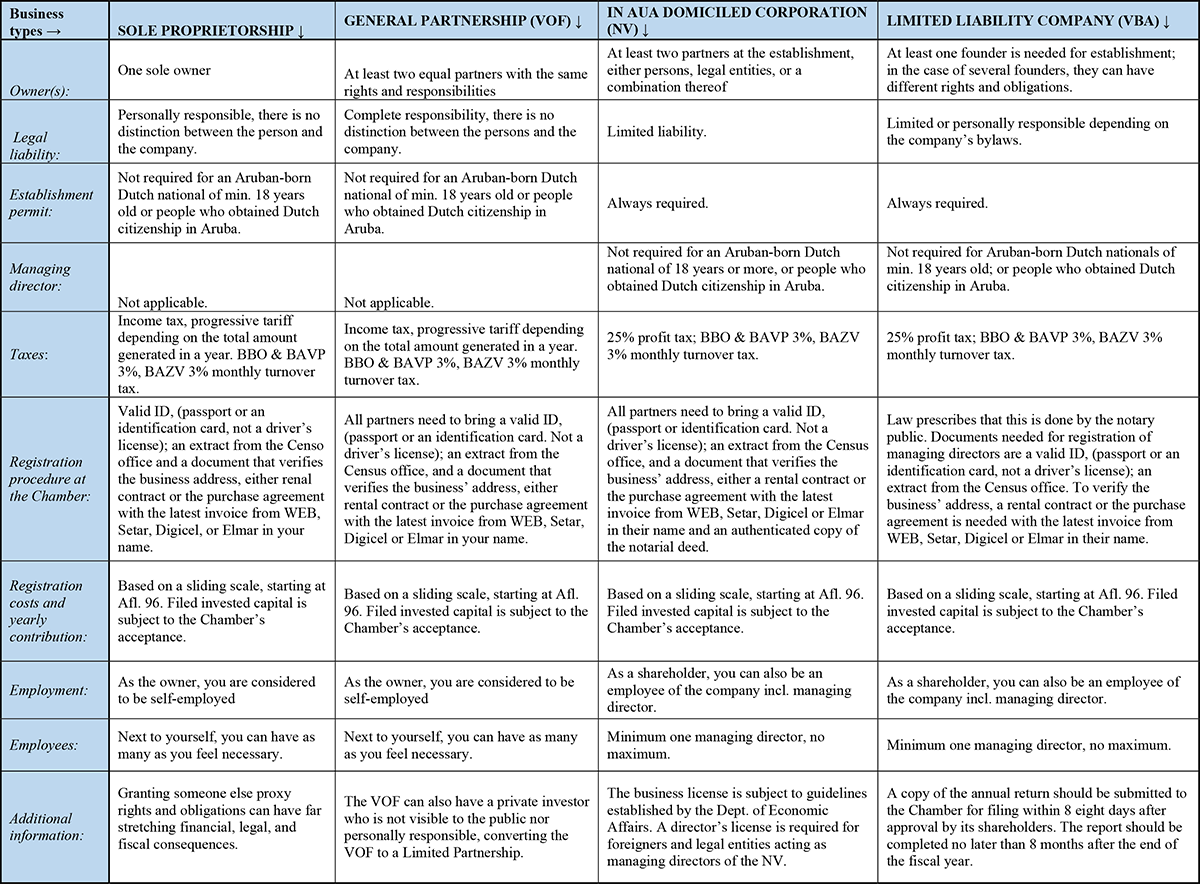

The choice of your business structure influences the day-to-day operations of your business, the applicable taxes and the number of employees. You must choose the one that offers you a better balance between protection and benefits.

Contents

Compare business structures

Compare business structures – PDF Document

List of the most common business structures

Sole proprietorship (“eenmanszaak”):

- It is owned by a natural person, not a legal entity.

- You can hire employees.

- You are required to list it in the trade register at the Chamber of Commerce and Industry.

- It has the right to a trade name.

- There is no separation between the assets of the company and the private assets; you are liable for the debts of your company.

- In case of marriage, it is advisable to sign a prenuptial agreement at a civil-law notary to avoid the listing of all private assets in bankruptcy.

- Business profit is business income (there is no difference between business assets and private assets).

- Applicable taxes are: income tax (progressive rate), BBO/BAVP 3% & BAZV 3% (calculated over the sales per month).

- Capital: none, only personal assets.

- It is a partnership to conduct business under a common name, not a legal body (no legal status).

- Collaboration between two or more individuals (natural or legal persons) who enter into a collaboration agreement.

- In principle, it is not possible to join or leave an existing partnership; the withdrawal of one or more partners will end the general partnership.

- When you practice a professional activity as your work, you can use a general partnership (for example, a carpenter or store owner).

- The partners are jointly and severally liable for the commitments agreed on by them or one of them.

- The partnership agreement (not a notarial deed) is the method of setting up a general partnership.

- Each partner needs a business license as a partner of the general partnership.

- A background check is not required.

- You are required to list the general partnership in the trade register at the Chamber of Commerce and Industry.

- For applicable taxes, each partner will be treated as an entrepreneur and will have to pay income tax (progressive rate), BBO/BAVP 3%, and BAZV 3% separately (calculated over the sales per month).

- Each partner is responsible for his or her debts and wage tax obligations.

- Capital: There is no minimum capital requirement; each partner’s contribution forms the capital of the general partnership.

- A corporation is a legal entity.

- A corporation is a business with a shared capital in which each of the partners can hold one or more shares.

- The capital of the corporation is divided into shares. The shares are registered.

- Shareholders are not jointly and severally liable. The directors are jointly and severally liable for the obligations entered into during the incorporation.

- Process of incorporation:

- notarial documents are required;

- it is mandatory to conduct a background check.

- Registration in the Trade Register of the Chamber of Commerce and Industry is required.

- The following taxes apply: profit tax is 25%, BBO and BAVP are 3% and BAZV is 3% (calculated over the sales per month).

- A corporation has three bodies:

- the general meeting of shareholders has the authority to amend the articles of incorporation or to dissolve the corporation;

- the board of managing directors is in charge of the affairs of the corporation, including asset management and representation at court;

- the corporation also has a supervisory board that advises and supervises the board of managing directors.

- A corporation can own and operate one or more businesses.

- A natural person or a legal person (legal representative (trustee)) can serve as the director.

- A limited liability company is a legal entity.

- The capital of the company is divided into shares.

- The law, articles of incorporation and regulations govern the registration and regulation of the shares.

- Liability: unless otherwise provided by law, shareholders, directors and other officers of the company are not personally liable for the company’s debts and are not required to contribute to the company’s losses.

- The limited liability company allows shareholders to be held personally liable as well. The articles of incorporation must state that this is possible. This mechanism is uncommon and is usually used for specific debts. In such a case, shareholders would be personally liable, similar to a general partnership.

- Process of incorporation:

- participation of one or more participants;

- the notarial deed must include the articles of incorporation, as well as the names, positions and objects;

- it is mandatory to conduct a background check

- The director must be a resident. If the director is not a resident, he must appoint a legal representative (trustee).

- Capital: there is no minimum capital requirement (but at least AWG 0.01).

- Registration in the Trade Register of the Chamber of Commerce and Industry is required.

- The following taxes apply: profit tax is 25%, BBO and BAVP are 3% and BAZV is 3% (calculated over the sales per month).

- A limited liability company has a basic structural requirement; the active director must reside in Aruba.

- A partnership is a group of people who work together to achieve a goal.

- It is not a legal entity; rather, it is an agreement between two or more people to bring something together so that they can all benefit from it.

- In principle, it is not possible to join or leave an existing partnership, and the withdrawal of one or more partners will end the partnership.

- A notarial deed is not required for formation.

- The partnership is motivated by a need for a specific profession or skill (for example, dentist, doctor and lawyer).

- Government supervision is not required.

- A background check is not required.

- Employees may be hired.

- Each partner is responsible for his or her own wage tax.

- Each partner is responsible for his or her own debts.

- The Chamber of Commerce and Industry requires registration in the Trade Register.

- The proportionate share of the partnership determines the participants’ responsibilities.

- Each partner contributes his or her own labor, funds, goods or services.

- When it comes to sharing the profits and losses, the partners take into account each other’s contributions.

- Capital: there is no minimum capital requirement (but at least AWG 0.01).

- Legal liability: each member is liable for a proportional share of the association’s total debt. Those who cease to be a member after less than a year are also liable.

- Modified liability: the liability of the members is limited and governed by the articles of association of the cooperative association.

- Excluded liability: the liability of the members is limited to the amount of money deposited.

- If the (predefined) period has come to an end.

- If the general meeting adopts a resolution to that end.

- If the cooperative association is declared bankrupt.

- A foundation is a legal entity that aims to achieve a goal outlined in its articles of association (with appropriate assets). A foundation has no members.

- A notarial deed is required for the formation of a foundation. The director(s) must be named in the notarial deed, as well as how they can be replaced.

- A business permit is required for any foundation operating for gain.

- Government supervision is not required.

- A foundation must be registered in the central foundation register at the Chamber of Commerce and Industry.

General partnership (“vof”):

Corporation (“naamloze vennootschap” (“N.V.”))

Limited liability company (“vennootschap met beperkte aansprakelijkheid” (“V.B.A.”))

Partnership (“maatschap”)

The following taxes apply: income tax (progressive rate), BBO and BAVP are 3% and BAZV is 3% (calculated over the sales per month).

Cooperative association (“coöperatieve vereniging”)

A cooperative association is a legal entity.

A cooperative association is defined as a voluntary association of people who come together to meet common economic, social and cultural needs, and the members may join the association and retire at any time.

Members of the cooperative association are fractional owners in the same way as shareholders in a corporation or a limited liability company. The statutory provisions outline the members’ responsibilities.

Those who cease to be a member after less than a year are also liable.

Member capital refers to the total amount of money that members have deposited as cooperative members. This mandatory deposit is referred to as the initial deposit. A cooperative association can eventually charge its members contributions for necessary expenditures.

The rights and obligations of the members: the property is owned by the members jointly. The general meeting is the highest decision-making body of the cooperative association. The general meeting appoints the directors. The board of directors is composed of five members, including a president, secretary and treasurer. The board of directors represents the cooperative association. The general meeting has the authority to remover a member of the board of directors. A commissioner is in charge of the board’s supervision.

It is possible to dissolve the cooperative association:

The dissolution of the cooperative association must be registered in the Trade Register of the Chamber of Commerce and Industry.